Definition of Wash Sale Rule

A wash sale is trading activity in which shares of a security are

sold at a loss and a substantially identical security is purchased within 30

days. The subsequent purchase could occur before or after the security is sold,

creating a 61-day window that must be monitored to identify wash sales.

IRS Explanation of Wash Sales

The IRS defines a wash sale as "a sale of

stock or securities at a loss within 30 days before or after you buy or acquire

in a fully taxable trade, or acquire a contract or option to buy, substantially

identical stock or securities." The wash sale rule under Section 1091 of

the Internal Revenue Code (IRC) is intended to prevent investors from

generating and recognizing artificial losses in situations where they do not

intend to reduce their holdings in the securities that are sold. For

purposes of Section 1091 wash sales occur when an investor realizes a loss on

the sale of a security and the investor acquires a "substantially identical"

security within a 61-day "window" that extends from 30 days before the date of

the sale to 30 days after the date of the sale. If an investor sells the

stock at a loss, and then buys a "substantially identical" replacement stock

within this 61-day window, a wash sale occurs and the loss is deferred until

the replacement shares are sold. The pro rata loss is added to the cost basis

of the replacement shares purchased, and the holding period of the replacement

shares includes the holding period of the original shares sold. However, the

deferred loss will eventually be recognized when the replacement shares are

sold. For more information about the IRS and the wash sale rule, please

see IRS

Publication 550.

Wash Sale Example

An investor buys 100 shares of Yahoo stock for $5,000 on October

1. On December 7 the investor sells these 100 shares of Yahoo stock for $4,500.

On December 16 the investor buys 100 shares of Yahoo for $4,750. Because the

investor bought substantially identical stock within 30 days of the sale of

Yahoo, a wash sale occurred and the loss of $500 on the sale of Yahoo cannot be

deducted. The loss is deferred and applied to the cost

basis of the new tax lot. Therefore, the wash sale in this example

would raise the cost basis of the new lot from $4,750 to $5,250.

If you sell a stock and your spouse (if filing jointly) or a corporation you

control buys a substantially identical stock, you also have a wash sale. In

these cases, the IRC states that losses from the sale of stock can not be

recognized at the time of sale, but must be deferred instead.

Wash sales can span tax years. For example, if you sold a stock for a loss in

December and repurchased the stock the following January you would have a wash

sale. For this reason it is important to include all January trades when

calculating your capital gains for the

Schedule D.

Wash sales can be very complicated to monitor. To see how

GainsKeeper can help investors monitor wash sales, please see the example in "How

GainsKeeper Helps Investors Tame Wash Sales."

What the Wash Sale Rule Really Means to Investors

If you are active in a particular stock, it is imperative that you

monitor your wash sales period before you re-purchase the stock. After you have

taken a loss, you need to be aware of the date you can repurchase a security

and still claim the earlier loss on taxes. Investors may find themselves not

being able to realize significant losses due to wash sales. Manually tracking

the wash sale periods or using a portfolio service such as GainsKeeper that can

account for wash sales, will prevent you from purchasing the stock in a wash

sale period. Nothing is more frustrating than selling stock at a loss to offset

your tax bill only to find out after January 1st that a wash sale disallowed

the loss.

While you will eventually realize losses deferred by wash sales,

avoiding them in the first place will help you maximize your investment

performance.

How to Avoid Wash Sales

Wash sales can be avoided by waiting to repurchase replacement

shares until after the 30-day window closes.

You can also avoid a wash sale by purchasing a similar security,

rather than an identical stock, to the one you sold for a loss. For example, if

you sold Yahoo for a loss and you were interested in investing in another

portal stock, then you could buy Google within the 30-day window and not

trigger a wash sale.

How GainsKeeper Helps Investors Tame Wash Sales

The wash sale rule tends to be confusing for investors, and can be

nearly impossible to keep up with for active traders. However, GainsKeeper

continuously monitors accounts for wash sales, and automatically updates cost

basis and capital gain/loss report for any wash sales within long trading

activity, short trading activity or option trading activity. Wash sales can be

avoided by using GainsAdvisor and waiting to repurchase replacement shares

until after the 30-day window closes.

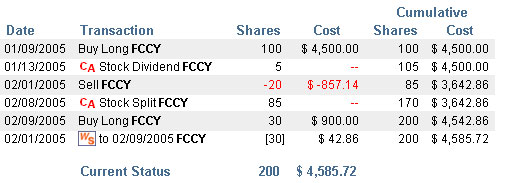

Below is an example of transactions that resulted in a wash sale. On 01/09/05

an investor bought 100 shares of FCCY. The investor sold 20 shares of FCCY on

02/01/05 and then purchased 30 shares of FCCY on 02/09/05.

Because FCCY was sold on 02/01/05 at a loss and shares of FCCY were bought

again within 30 days of the sell, a wash sale was triggered. GainsKeeper

automatically adjusts for wash sale activity and

corporate actions as can be seen in the following example.

Wash sales always pose challenges for investors, but they border on impossible

when combined with corporate actions as evidenced in the following example:

- Corporate Action was

applied - Corporate Action was

applied  - Wash

sale was applied - Wash

sale was applied

This is just one example to illustrate how

corporate actions, such as the stock dividend on 01/13/2005 and stock split on

02/08/2005, can combine with wash sales to create an investor's capital gains

nightmare. Portfolio trackers and other tax programs aren't able to solve these

complicated record-keeping brain teasers.

GainsKeeper also aggregates holdings in multiple brokerage

accounts. If you have multiple brokerage accounts, or you and your spouse file

jointly, you can track them all in a single GainsKeeper account. GainsKeeper

will look across all funds to identify wash sales and potential wash sales.

GainsTracker monitors and automatically adjusts for wash sales

activity that affects the cost basis of your investments to help keep you out

of trouble with the IRS. GainsKeeper's definition of "substantially identical"

securities is consistent with the IRC and includes options and convertible

bonds. Because preferred stock of a corporation generally provides owners with

different rights and benefits, the IRC does not consider it to be substantially

identical. GainsKeeper calculates wash sales within individual securities

traded long or short. GainsKeeper does not adjust for wash sales across long

and short holdings. Nor will GainsKeeper generate a wash sale if you sell an

equity at a loss, and then open a call option for the same equity within the

wash sale window. Please consult your tax advisor if you want wash sale

analysis across long and short transactions or if you wish to identify

significantly identical securities.

GainsKeeper will detect and adjust cost for wash sales across

options of the same symbol. If you sell a call option for a loss, and then

purchase the same call option within the 61-day wash sale window, GainsKeeper

will defer the loss and add it to the basis of the option. The same scenario

applies for the sale and purchase of put options.

If you have any wash sale adjustments, there are a few different places where

you will see the adjustments in GainsKeeper. One area is the Realized/Sell

Activity view in GainsTracker / View Accounts. You can also see wash sale

adjustments in your Realized report, found in Tax Center / Custom Reports.

|